.png)

A COVID-19 video series featuring 1st Priority Mortgage President Brooke Anderson-Tompkins.

1st Priority Mortgage is committed to serving you during unprecedented times. In two videos released by 1st Priority Mortgage, Inc. on Friday, March 20, and Friday, March 27, President Brooke Anderson-Tompkins addressed a number of questions our mortgage professionals are encountering on the frontlines of business, from “Are you open for business?” to “What happens if my rate expires?” and more.

Q: Are you open for business?

A: Absolutely, we are open, taking applications, and closing loans! We are ready and able to work through challenging times, having deployed a mix of strategies to address COVID-19 concerns; this includes onsite and remote work.

Q: Can I prequalify or apply for a loan without meeting in person?

A: Yes, good news, and this is not new. We are happy to accommodate a multitude of ways to connect: by phone, by video and/or electronically for documents to be shared and/or signed.

Q: What happens if my rate expires?

A: We will continue to take the “look at the whole” approach. As individual situations, variations among counties, and the frequent domino effect are in play, we will look at each deal to achieve the best solution for the many moving parts and parties to the deal.

Q: I heard rates went to zero on the news, so why isn’t the mortgage rate zero?

A: The Federal Reserve lowered the target on the Federal Funds rate to 0%. This is the interest rate that member banks can use to borrow from each other. Mortgage rates are not directly connected to the Federal Funds rate. Mortgage rates are based on the Mortgage Backed Securities (MSB) market; they somewhat follow the 10-year Treasury Bill (T-Bill) rate. Currently all lenders are experiencing a volatile interest rate market due to unprecedented times. Please contact your Mortgage Consultant to address your specific concerns.

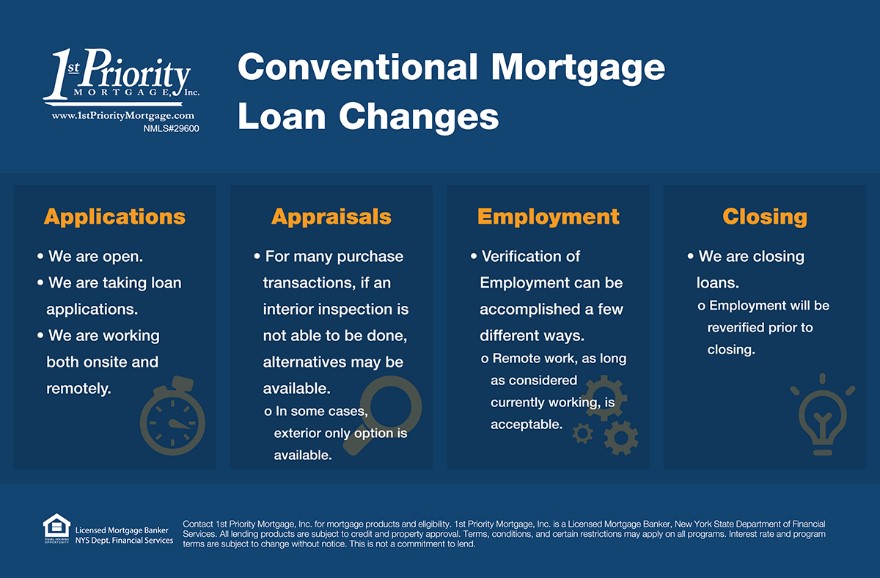

Q: How have conventional mortgage loan applications changed?

A: The mortgage transaction has many moving parts reliant on multiple players throughout the process. Here’s how it improved today for conventional mortgage loan applications.

We remain operational for all mortgage applications; the above updates apply to conventional mortgage loans. Government loan guidance (FHA, VA & USDA) will be provided as it becomes available. Contact your Mortgage Consultant or Loan Coordinator with questions.

1st Priority Mortgage continues to serve.

1st Priority Mortgage is still working hard to serve you. As each day brings new information, we will adjust accordingly both internally and with the many stakeholders involved with each deal. Contact 1st Priority Mortgage for how these responses may impact your deal directly.

For a full list of Mortgage Consultants and offices, please visit: www.1stPriorityMortgage.com or call (888) 500-9733.

Contact 1st Priority Mortgage, Inc. for mortgage products and eligibility. 1st Priority Mortgage, Inc. is a Licensed Mortgage Banker, New York State Department of Financial Services, NMLS #29600. All lending products are subject to credit and property approval. Terms, conditions, and certain restrictions may apply on all programs. Interest rate and program terms are subject to change without notice. This is not a commitment to lend. Contact a 1st Priority Mortgage Consultant for full details. (888) 500-9733.

Contact 1st Priority Mortgage, Inc. for mortgage products and eligibility. 1st Priority Mortgage, Inc. is a Licensed Mortgage Banker, New York State Department of Financial Services, NMLS #29600. All lending products are subject to credit and property approval. Terms, conditions, and certain restrictions may apply on all programs. Interest rate and program terms are subject to change without notice. This is not a commitment to lend. Contact a 1st Priority Mortgage Consultant for full details. (888) 500-9733.

Start Loan Process

Start Loan Process My Account

My Account